The End of an Era: Ukraine Cuts Off Russian Gas Transit

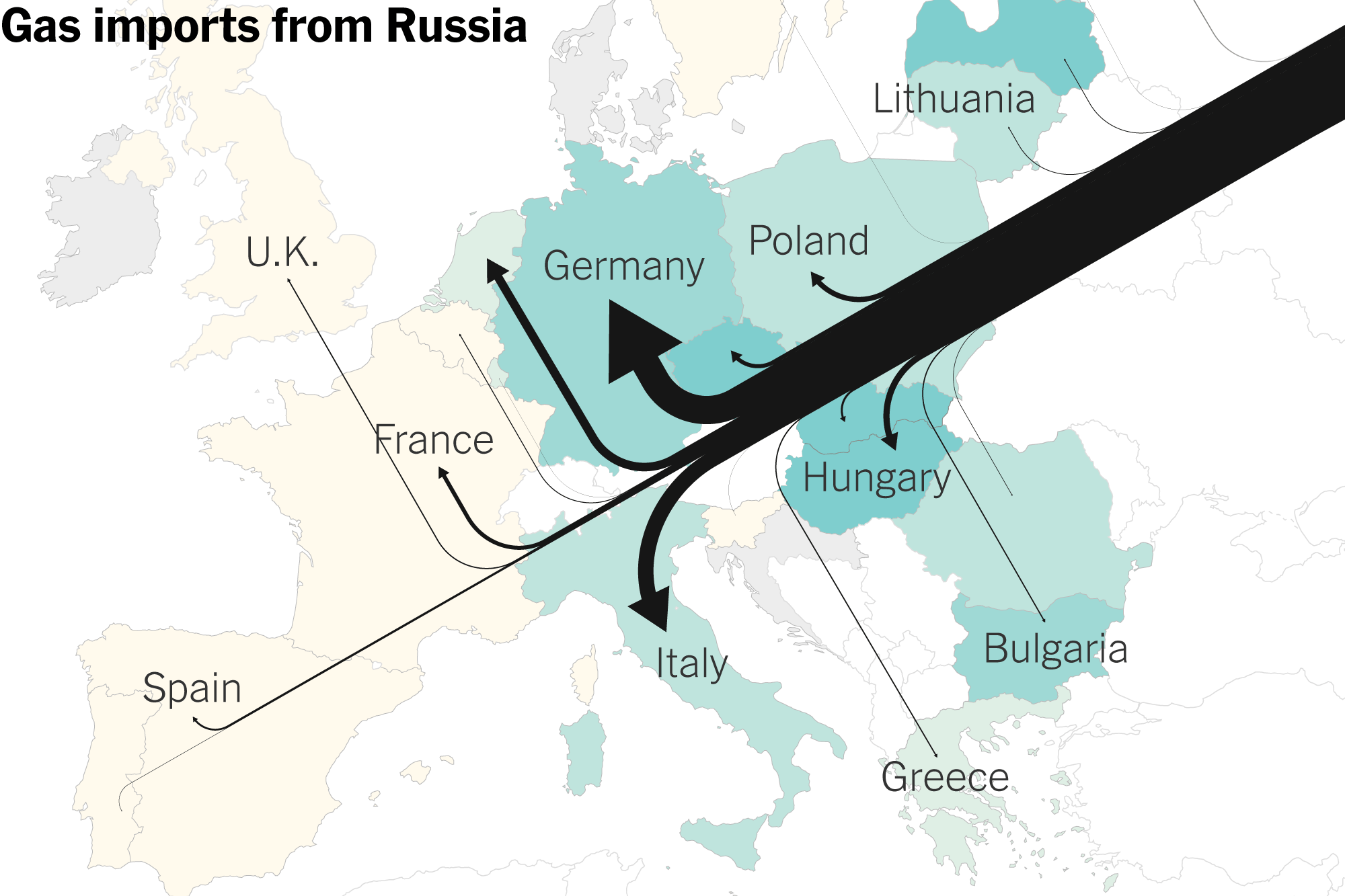

Ukraine has fulfilled its long-stated intention to sever the transit of Russian gas to Europe, ending an arrangement that had endured decades of geopolitical upheaval. The Ukrainian energy ministry hailed the move as a “historic event,” citing national security interests. While the European Union (EU) has drastically reduced its reliance on Russian gas since 2022, the implications of this decisive action are multifaceted and far-reaching.

Economic Fallout and Regional Impacts

The decision to cut off Russian gas transit through Ukraine has significant economic and geopolitical consequences. Below is an overview of the key effects:

Economic Fallout

- Ukraine’s Financial Strain: By cutting off Russian gas transit, Ukraine forfeits approximately $800 million annually in transit fees—a significant loss for its war-strained economy. However, Kyiv’s decision reflects a prioritization of sovereignty and strategic alignment over immediate economic benefit.

- Gazprom’s Mounting Losses: Russia’s state-owned gas giant Gazprom reported a $6.9 billion loss last year due to diminished European sales, its first such loss in two decades. The end of Ukrainian transit will deepen this revenue shortfall, forcing Russia to accelerate its pivot to alternative markets like China.

- European Consumers: The immediate impact on European gas prices has been muted, thanks to preparations made by EU nations. Nevertheless, persistent rises in spot prices and elevated energy costs could exacerbate inflationary pressures and increase the economic strain on households and industries.

Regional Winners and Losers

- Austria, Hungary, and Slovakia: These countries, major recipients of Russian gas via Ukrainian pipelines, face heightened economic pressures. Slovakian Prime Minister Robert Fico warned of the “drastic” impact on European energy markets, emphasizing that higher gas and electricity costs will ripple through economies reliant on natural gas for industry and heating.

- Moldova’s Transdniestria Region: The immediate effect of the deal’s expiration has been severe for this breakaway region, which is now grappling with reduced heating and hot water supplies. This underscores the broader risk to less integrated European neighbors relying on Russia for energy.

- Norway, the U.S., and Qatar: Norway continues to strengthen its role as a stable pipeline supplier to Europe, while the U.S. and Qatar are poised to capitalize on increased LNG demand. Investments in new LNG infrastructure across Europe will solidify their roles as long-term suppliers.

- Poland and the Baltic States: Poland and the Baltic countries, which diversified early by developing LNG terminals and alternative pipelines, emerge as strategic winners. Their preparation underscores the benefits of early investments in energy resilience.

The Broader Energy Landscape: The EU reduced Russian gas imports from over 40% of its total supply in 2021 to 8% in 2023, driven by coordinated efforts to bolster LNG imports and diversify pipeline sources. Despite these successes, the bloc’s reliance on Russian LNG imports remains a complicating factor as it targets a full phase-out of Russian fossil fuels by 2027.

Symbolism vs. Strategy: Ukraine’s move is as much about symbolism as strategy. By halting Russian gas transit, Kyiv demonstrates its commitment to breaking free from Moscow’s economic grasp. For Europe, the decision reinforces the urgency of reducing dependency on Russian fossil fuels, a goal complicated by economic and logistical hurdles. However, the move also invites questions about unity within the EU, with Slovakia’s and Hungary’s concerns highlighting potential intra-European tensions.

What Lies Ahead?: The end of the Russian gas transit deal is a critical inflection point in the post-2022 energy paradigm. While it accelerates Europe’s transition to diversified and renewable energy sources, the journey will be fraught with economic and political challenges. If Europe can weather these disruptions, the move will stand as a turning point in achieving long-term energy security. Conversely, if higher costs and supply bottlenecks deepen fractures within the EU, the symbolic victory of cutting ties with Russian gas may come at a steep price. The question remains: Can Europe sustain its united front as it navigates the dual pressures of energy security and economic stability?